ADDRESSING ENVIRONMENTAL PERFORMANCE UNDER CONCENTRATED CORPORATE OWNERSHIP

- January 13, 2025

- Posted by: sarangmangi

- Category: Insights

How Should Regulatory Bodies Address Environmental Performance Under Concentrated Corporate Ownership?

Concentrated corporate ownership presents significant challenges for environmental regulatory institutions and intergovernmental bodies. When powerful shareholders control corporations, their influence on environmental behavior can either support or undermine regulatory objectives. Recent cases highlight this regulatory challenge: despite having a controlling owner (Ramsbury Invest AB with 57.5% stake), H&M faced major environmental compliance violations through greenwashing. Similarly, Duke Energy, which is controlled by three of the largest institutional owners, committed federal environmental crimes resulting in 39,000 tons of toxic coal ash contamination despite concentrated institutional ownership from major funds. These cases demonstrate how ownership structure impacts the effectiveness of environmental regulation.

For regulatory institutions, prior research reveals conflicting patterns in how concentrated owners respond to environmental oversight. Some evidence suggests these powerful shareholders could support regulatory objectives through their heightened sensitivity to penalties and reputational damage. Their significant stake in corporate performance theoretically increases their attention to environmental compliance risks and regulatory sanctions. Under this view, concentrated ownership should drive better environmental performance through owners’ increased awareness of regulatory risks and long-term value implications.

However, Property Rights Theory indicates that concentrated owners often prioritize financial returns over environmental compliance. Research shows these shareholders frequently pressure management to maximize short-term value, reducing resources available for environmental investments. Indeed, evidence indicates that blockholders may prioritize financial performance to the extent of not only discouraging environmentally responsible behavior but also condoning violations of environmental rules and regulations.

A comprehensive analysis of 16,286 observations from 3,275 firms across 43 regulatory jurisdictions between 2008 and 2017 provides crucial insights for regulatory institutions. The evidence demonstrates that concentrated owners tend to externalize environmental costs unless effectively constrained by regulatory frameworks. While ownership concentration generally reduces environmental performance, this relationship changes significantly based on regulatory strength. Concentrated ownership can support better environmental outcomes in jurisdictions with robust environmental enforcement and corporate governance requirements. However, weak regulatory environments amplify negative environmental impacts.

This research extends regulatory understanding by revealing how institutional frameworks shape environmental behavior under concentrated ownership. It demonstrates that corporate environmental performance depends heavily on the strength of regulatory oversight and enforcement capabilities. For regulatory bodies, these findings illuminate how governance mechanisms influence environmental compliance when dealing with powerful corporate owners.

The evidence points to several key institutional approaches that regulatory bodies should implement. Environmental protection frameworks should incorporate ownership structure considerations into their fundamental design, recognizing that different ownership patterns require distinct regulatory approaches. Concentrated ownership, in particular, demands robust oversight mechanisms to prevent the externalization of environmental costs.

Regulatory institutions should develop governance frameworks that specifically address the challenges posed by powerful shareholders. This means establishing environmental compliance systems that can effectively monitor and enforce standards even when faced with resistance from concentrated owners. Board independence requirements become especially crucial in these contexts, as they help counterbalance the influence of powerful shareholders, while specialized enforcement mechanisms must be calibrated to overcome potential resistance from these owners.

For international bodies and regulatory institutions working across jurisdictions, the findings emphasize the importance of building comprehensive environmental governance systems. These systems should integrate both external enforcement capabilities and internal governance requirements. Particular attention should focus on strengthening regulatory frameworks in contexts where institutional capacity may be limited, as these environments show the strongest negative effects from ownership concentration.

Most significantly, regulatory bodies should recognize that environmental protection requires carefully designed oversight mechanisms that can both constrain and channel the influence of concentrated owners. When properly structured, regulatory frameworks can transform the relationship between ownership concentration and environmental performance from negative to positive – but this transformation depends on creating institutional environments that effectively align the interests of powerful shareholders with environmental protection objectives through comprehensive solutions that address the complex interactions between corporate ownership and environmental behavior.

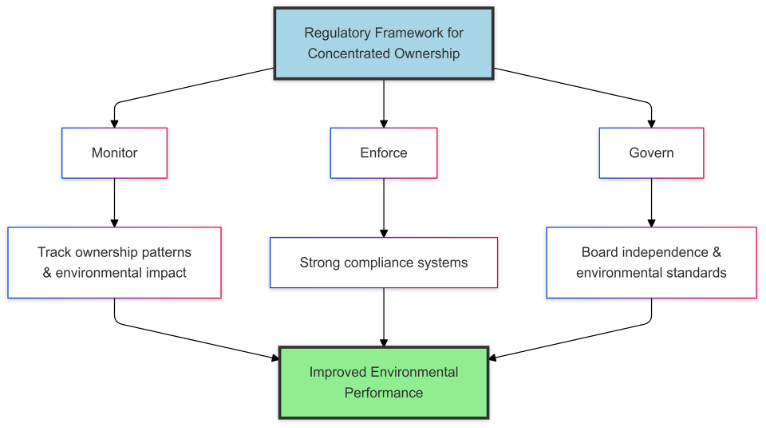

Figure 1. Regulatory Framework for Environmental Performance Under Concentrated Ownership

This framework illustrates the three key pillars of effective environmental regulation—monitoring, enforcement, and governance—and how they contribute to improved environmental performance when dealing with concentrated corporate ownership structures.

(This post is based on the open-access study published in the Global Strategy Journal, which can be accessed directly here: https://onlinelibrary.wiley.com/doi/10.1002/gsj.1518).